JUNIPER BOOKING ENGINE

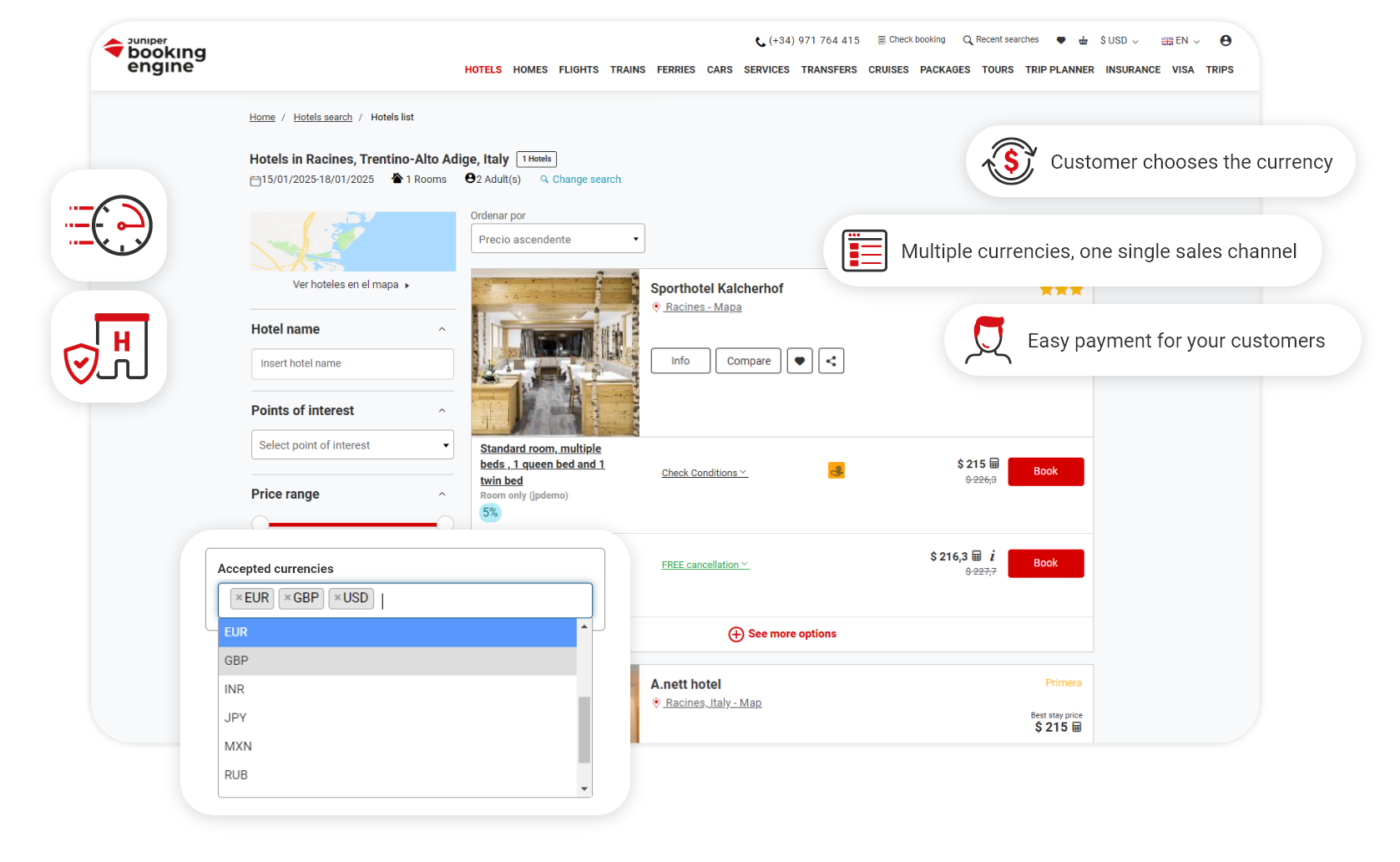

Juniper Multicurrency

Work with different currencies without having to contract multiple sales channels!

JUNIPER BOOKING ENGINE

Work with different currencies without having to contract multiple sales channels!

The Multicurrency module allows you to operate with different currencies without having to contract a sales channel per currency.

We proceed to show a simplified example of the distribution flow (purchase -sales) with different currencies:

In our example:

Without the Multicurrency module the system applies only one exchange rate conversion to the currency of the sales channel.

In this flow there is no exchange rate applied.

This setting is used to return the sales price in the supplier currency, this is usually the way, where sales are being made through Webservice sales channels.

Within the same sales channel you may see each result (Availability) in the base currency of the supplier (their local currency). Therefore, in the same results you may find the same Hotel with prices in different currencies and the customer will end up paying in the currency they have previously selected for that specific offer.

Following the graph:

Following the graph:

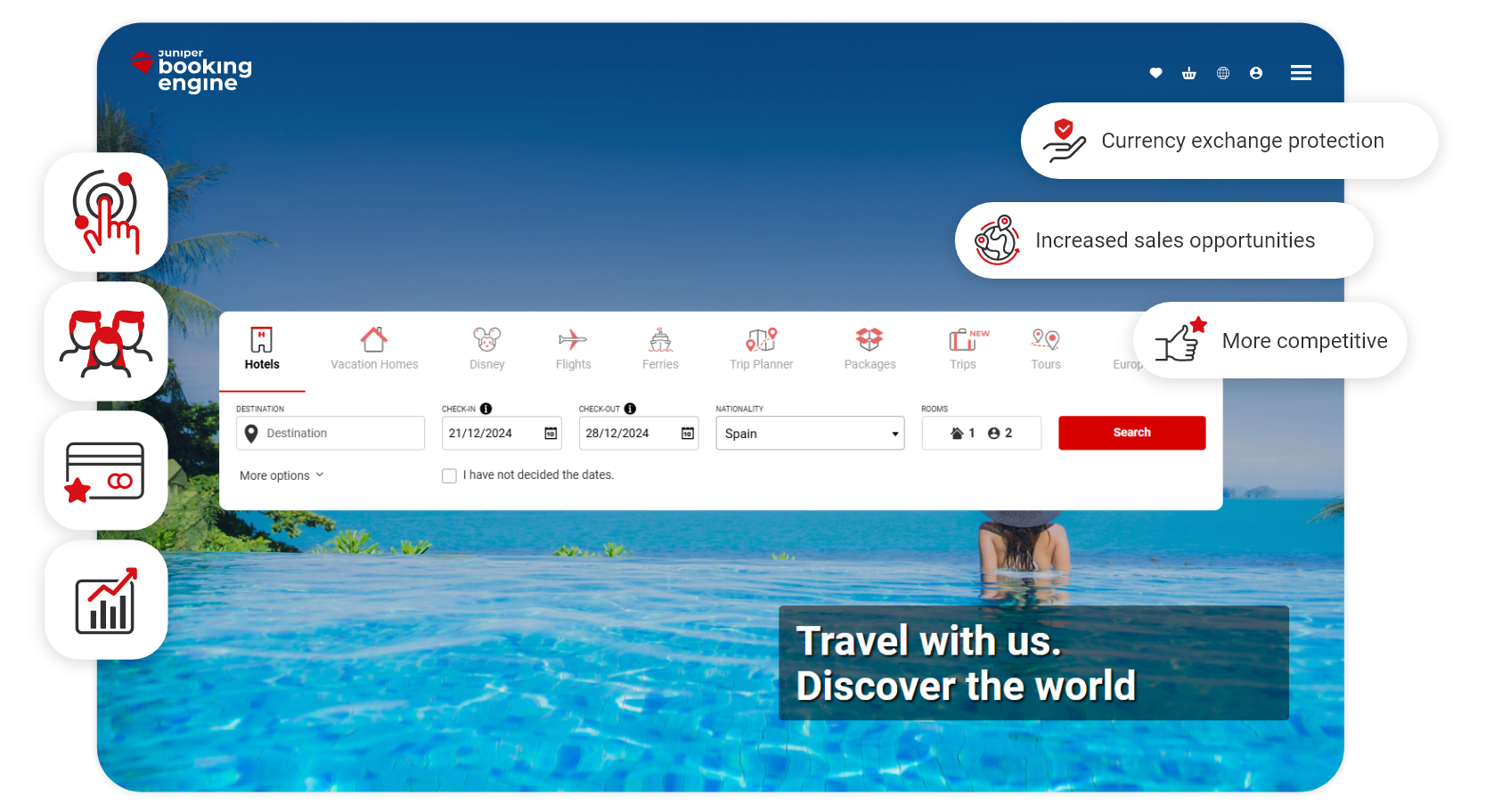

In Juniper we have currency protection, which you may review and check in our connections.

Currency protection systems

It is a system that allows the Juniper client to manage the volatility of the currencies with which it operates to protect its profit margin. It is particularly useful if one is not operating with the most internationally used and stable currencies. Therefore, it acts as an additional feature of the Multicurrency module (it is a Service provided by an external supplier).